Find a Bookkeeper near you

The average rating for Bark Bookkeepers is 4.88, based on 181,846 reviews

What's the average cost of a freelance bookkeeper? Find out the average rates for bookkeepers in the US, set your budget, and find a brilliant bookkeeper for your business with our price guide.

Last updated: 21 August 2025

As a business owner, your energy is best spent on high-impact areas like sales, production, and team management. While these are critical for growth, consistent and accurate bookkeeping is essential for financial stability.

Instead of getting bogged down in receipts and statements, consider hiring a bookkeeper to manage your finances.

In this guide, we will break down what a bookkeeper does, the average cost of a bookkeeper in different parts of the USA and what impacts the price you pay.

A bookkeeper maintains the day-to-day financial records of a business. Their core responsibilities include posting journal entries, assisting with payroll, reconciling bank accounts, reviewing the general ledger, and paying client bills. By keeping financial data organized, a bookkeeper ensures all necessary information is readily accessible for tax preparation. They often work in conjunction with an accountant, who uses these records to perform more advanced tasks like generating financial statements and assessing the overall financial health of the business.

While the titles are often used interchangeably, the roles of a bookkeeper, accountant, and CPA are distinct, with each playing a part in the financial health of a business. Understanding which role does what is key to hiring the right help for your business:

Bookkeeper: Records the day-to-day financial transactions of a business (e.g., sales, purchases, payments). They focus on maintaining accurate ledgers.

Accountant: Analyzes, interprets, and reports on the financial data recorded by the bookkeeper. They prepare financial statements, help with budgeting, and prepare tax returns.

CPA (Certified Public Accountant): A state-licensed accountant who has passed a rigorous exam and met specific experience requirements. CPAs can perform all the duties of an accountant but are also legally authorized to conduct external audits and represent clients before the IRS.

Bookkeeping isn’t a one-size-fits-all service, and the price reflects the customized nature of the work.

In the US, the average monthly cost for a bookkeeper is $500, according to the latest data from Bark. However, prices can range from $200 to $3,500 per month depending on the complexity of financial activities, the volume of transactions, and the inclusion of services like payroll and tax preparation.

Larger businesses that require intricate financial reporting for multiple departments might find themselves at the higher end of the spectrum, while a smaller operation might secure bookkeeping services at the lower end. The average cost often includes monthly financial statements, bank reconciliation, accounts payable, and receivable support, giving you a full financial package.

If you prefer to engage bookkeeping services on an hourly basis, freelance bookkeepers charge on average between $35-$55 per hour. This range allows for the variance in specialization and experience levels.

For businesses with irregular transactions, hourly rates might offer cost savings, as you’d pay for the time the work actually takes. However, it’s important to agree on a maximum monthly fee to prevent any unexpected spikes in your bookkeeping expenses.

Like any professional service, the cost of a bookkeeper is based on a variety of factors. Understanding what goes into their pricing can help you find the right professional for your business and budget. Here are the key elements that shape a bookkeeper's quote.

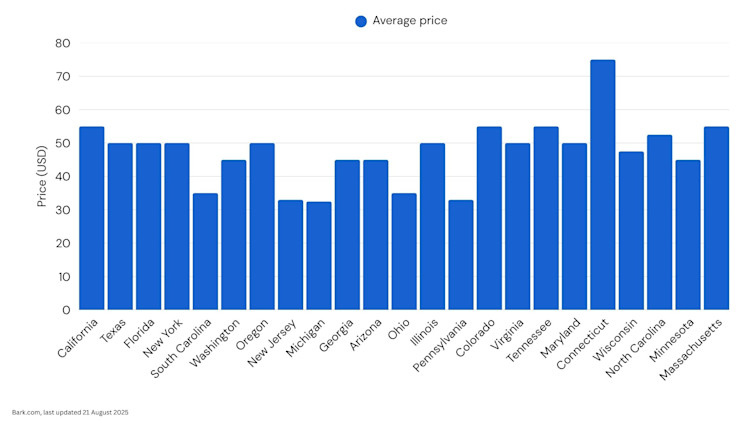

A bookkeeper's location will influence their rates, and will primarily be driven by the local cost of living and market demand. Bookkeepers in major cities like San Diego, New York City, and Dallas will typically charge more to cover higher living and business expenses.

In contrast, bookkeepers based in smaller cities and regions with a lower cost of living can often offer more competitive pricing for the same services.

Here are the latest average costs for some of the most popular cities:

| City | Average monthly cost | Average hourly cost |

| Los Angeles | $250 | $55 |

| New York City | $275 | $52.50 |

| San Diego | $200 | $265 |

Deciding when to hire a bookkeeper isn't about hitting a specific revenue target; it's a strategic decision based on your time, resources, and operational efficiency. As a general rule, if you are spending more than a few hours each month on bookkeeping tasks yourself or your financial records are falling behind or becoming disorganized, it might be time to get professional help.

Larger businesses will usually have greater bookkeeping needs, and therefore are likely to command a higher price. In comparison, smaller businesses are likely to require less support and therefore costs are likely to be lower.

The accounting software your business uses is a factor in the cost of bookkeeping services.

If you already have software: Most bookkeepers are highly proficient in industry-standard platforms like QuickBooks and Xero. If you use one of these, finding an expert is straightforward. However, if your business relies on less common or specialized, industry-specific software, you may face higher costs, as the bookkeeper will need niche expertise or extra time to learn a new system.

If you don't have software: A professional bookkeeper will almost certainly recommend adopting a modern, cloud-based platform to manage your accounts efficiently. The subscription fee for the software is a direct business expense that you will be responsible for, separate from the bookkeeper's service fees. In many cases, bookkeepers can access wholesale pricing and pass those savings on to you.

As with most services, you will likely pay more for an experienced bookkeeper than someone who is just starting out.

A bookkeeper with professional qualifications is also likely to command a higher price. For example, a bookkeeper who is certified by the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB) is likely to charge more than their non-certified peers.

It's time to hire a bookkeeper when:

You are spending more than a few hours each month on bookkeeping tasks yourself.

Your financial records are falling behind or becoming disorganized.

You are not confident in the accuracy of your financial reports.

You are preparing to apply for a loan or seek investment.

Your business is growing, and the number of transactions is becoming overwhelming.

You need to focus your time on growing the business rather than on administrative tasks.

While the value of good bookkeeping can't be overstated, there are ways to make hiring a bookkeeper more affordable:

The more organized your financial records are, the less time a bookkeeper will need to spend sorting them out, which translates to lower costs. If your business is just getting started, implement good record-keeping practices immediately. For example ensure receipts are digitised and expenses are categorized.

Providing your bookkeeper with regular updates can save time and money by preventing small issues from becoming large, costly corrections down the road. Proactive communication ensures there are no last-minute surprises.

If you have a consistent volume of bookkeeping work, it might be worth hiring a bookkeeper on a monthly retainer. Not only will this mean you will always have help available each month, but it can save on paying hourly rates and provides you with a predictable monthly expense for your budget.

Depending on your needs and budget, hiring a professional on a part-time or "fractional" basis may be more cost-effective than a full-time employee. This ensures you're only paying for the work that needs to be done, not for downtime.

As mentioned, experience and qualifications will likely lead to higher costs so it’s worth considering what level of expertise you need. While you may want a CPA for tax strategy and filing, a skilled bookkeeper can often handle routine financial management at a more affordable rate, offering a great mix of expertise and value.

Hiring a freelance bookkeeper is often cheaper than contracting with a large accounting firm. Independent professionals typically have lower overhead costs, and those savings are often passed on to their clients.

Average price per hour refers to the median price per hour to allow for outliers in data.

*Information by state has only been provided where there is a large enough sample size.

The average rating for Bark Bookkeepers is 4.88, based on 181,846 reviews